The Industry's Leading

Clean Fleet Resource

2025 Market Brief

Clean Technology Expands Despite Uncertainty

The 2025 Market Brief offers a comprehensive analysis of an industry navigating regulatory transformation while continuing to invest in clean transportation solutions. As federal policies shift and the market innovates, the transportation industry is adapting, demonstrating both resilience and a sustained expansion of cleaner, more efficient technologies.

Download the brief to understand the trends shaping clean fleet adoption in 2025 and beyond.

2025 Key Findings

Federal policy priorities shift to conventional fuels. States lead ZEV charge.

Federal policy priorities shift to conventional fuels. States lead ZEV charge.

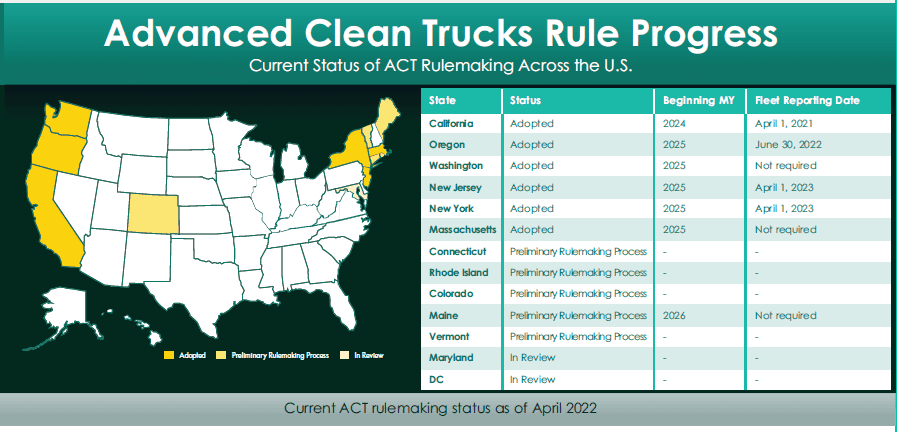

The U.S. transportation policy landscape is evolving rapidly, with significant uncertainty surrounding emissions regulations. Early Executive Orders (EOs) signal the Trump administration’s intent to roll back many Biden-era and pre-Biden policies, including Environmental Protection Agency (EPA) waivers that allow California and opt-in states to enforce stringent emissions regulations for light-duty and commercial vehicles. Although legal challenges are expected, these actions create peak uncertainty for emissions regulations at the federal level.

An EO that directed the EPA to reconsider its 2009 endangerment finding on climate change could jeopardize Phase 3 (2024) GHG regulations for HD vehicles and emissions guidelines for power plants. Another EO has halted the distribution of funding granted under the Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA), creating uncertainty for incentive programs for EVs, natural gas, and hydrogen in 2025 and beyond.

Regulatory uncertainty intensified with the 2024 Supreme Court ruling in Loper Bright Enterprises v. Raimondo that overturned the longstanding “Chevron Doctrine.” This shift could delay or invalidate EPA GHG regulations, including Phase 3, as the Clean Air Act lacks explicit authority over GHG emissions.

Despite federal uncertainty, state policies remain unaffected and many states, local governments, air districts, and utilities continue exploring tools to support low- and zero-emission goals, such as Indirect Source Rules (ISRs), climate disclosure requirements, and state and local fleet regulations. More than 600 state and local programs totaling over $13.5 billion in funding remain available for ZE and NZE projects, including natural gas, battery-electric, hydrogen, and even newer diesel vehicles. These resources are independent of federal funds and unaffected by EOs.

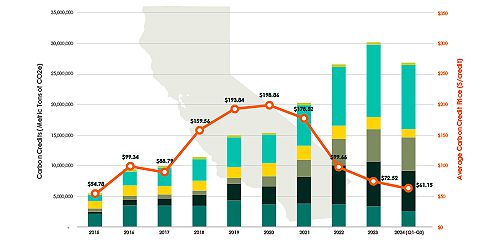

California responded to the federal regulatory shift by pausing ZEV adoption requirements on private sector fleets. Paradoxically, the move may expand funding opportunities for many fleets. Most funding programs are only available to fleets who have met state compliance requirements. The state’s ample funding opportunities for ZEV adoption are now available to more fleets that were previously prohibited from using them to meet ZEV adoption requirements.

With the pressure off to electrify in California, another result for many fleets is to expand their search for ZEV opportunities to a greater number of geographies. Fleets also have greater flexibility in scaling adoption of a broader mix of technologies, such as efficiency products and practices, RD, BD, CNG, and RNG. As has been demonstrated each year in the State of Sustainable Fleets Market Brief, many of these technologies have proven their superiority for both operations and cost in the right fleet types, facilities, and locations.

Renewable diesel supply and uptake grows. Fleet leaders capture efficiency gains.

Renewable diesel supply and uptake grows. Fleet leaders capture efficiency gains.

Fleets are increasingly adopting renewable fuels to cut GHG emissions, with 39% of fleets responding to the annual survey reporting that they use renewable diesel and 29% report BD use. Supply and demand for RD continue to rise, with one industry group noting that more fleets are researching and seeking RD after facing hurdles with other technologies. Leading OEMs have endorsed compatibility of their engines with the highest blends of RD, up to 99% replacement of conventional diesel.

RD production grew 28% in the first half of 2024 compared to the same period in 2023, with the Energy Information Administration (EIA) projecting a modest increase to 7.2 million gallons per day in 2025. BD and RD combined replaced 70% of conventional diesel used in transportation in the state for the first three quarters of 2024.

ASTM D6751 updates in 2024 tightened BD fuel specs, reducing metal content for better engine aftertreatment compatibility. The updates don’t shift original equipment manufacturers’ (OEMs) blend rating for their equipment, and warranties only support blends up to B20, requiring modifications like Optimus Technologies’ system for higher blends. This system runs on B100 but relies on conventional diesel at startup and shutdown.

Although RD and BD remain costlier to produce than conventional diesel, renewable fuel prices have closely tracked diesel over the past year. Government incentives such as carbon reduction- and renewable fuel-tax credits are essential for producers as well as end users but shifting federal priorities and changes to the tax code create uncertainty. With federal incentives in flux, state policies may drive RD and BD growth.

Meanwhile, HD vehicle manufacturers are refining internal combustion engines (ICEs) to meet tightening emissions rules. California’s Low-NOx Omnibus Rule requires cleaner engines, while OEMs are already innovating for 2027 EPA regulations. All major OEMs and engine manufacturers now offer at least one diesel engine that is compliant with California’s standard.

HD trucking fuel efficiency has seen mixed gains in recent years, with competing factors balancing out. The biggest opportunities for additional efficiency gains lie in adopting proven fuel-saving technology and modernizing fleets with newer vehicles. Despite slowed fuel economy gains, fleets benefited from an 11% drop in fuel costs, with U.S. diesel averaging $3.21 per gallon, down from $3.83 in 2023.

15-liter natural gas sales begin amid steady vehicle sales. Low CNG prices hold steady, though savings erode, and tax questions arise.

15-liter natural gas sales begin amid steady vehicle sales. Low CNG prices hold steady, though savings erode, and tax questions arise.

The first commercial 15-liter natural gas deployments in North America rolled out in late 2024, with at least 40 fleets placing orders for Cummins X15N-equipped trucks by September 2024. Given the late-year rollout, its full market impact remains unclear but will come into focus throughout 2025.

Natural gas Class 8 tractor registrations nationally surged nearly 50% year-over-year to 2,317 units in 2024, marking a sharp rebound after two years of declining natural gas tractor registrations. Transit bus registrations rose 3% to 684 units, while straight truck registrations fell 12% to 1,190 units. School bus registrations saw the steepest drop, down 54% to 89 units. Refuse, which remains strong adopters of NGVs due to cost savings and emissions reductions, experienced a 43% increase in registrations, reaching 2,624 trucks in 2024.

CNG prices remained stable in 2024 as they have been for most of the past decade, but cost savings narrowed due to declining diesel prices. Public CNG pumps averaged $3.37 per diesel-gallon equivalent (DGE), offering a $0.25 savings over diesel on average during the year, down from $0.90 per DGE the previous year. Despite fluctuating diesel prices, fleets report consistent fuel savings.

Tax incentives historically have improved the ROI and lowered the total cost of ownership for NGVs, but the evolving tax structure introduces new variables. The $0.50/gasoline-gallon equivalent Alternative Fuel Tax Credit (AFTC) expired at the end of 2024. The new 45Z tax credit under the IRA aims to replace AFTC but excludes conventional CNG suppliers due to its stricter emissions threshold. The tax credit can only be captured by RNG, and the value of the credit increases with greater (GHG) emissions reductions, while projects developed using prevailing wage and apprentice programs can also earn substantial credit values.

The RNG market continues to expand throughout the country, with use increasing 234% over the past six years. There are now over 400 operational facilities, 130 under construction, and 233 planned as of late 2024. These planned projects represent a potential 60% increase in production capacity. This national expansion parallels increased fleet access, with the number of natural gas stations offering RNG increasing 63% in 2024, further enhancing availability for end users. Growing supply of ultra-low GHG emission RNG from animal manure is driving up availability and driving down the emission impact for fleets nationally.

Federal BEV support pulls back while EV sales rise, new infrastructure solutions emerge.

Federal BEV support pulls back while EV sales rise, new infrastructure solutions emerge.

Major policy shifts are rolling back or pausing previous federal investments and commitments in BEVs, suggesting a pivot away from federal support for the vehicles. However, state and local regulations and incentives continue to drive and, in some cases, mandate ZEV sales or adoption.

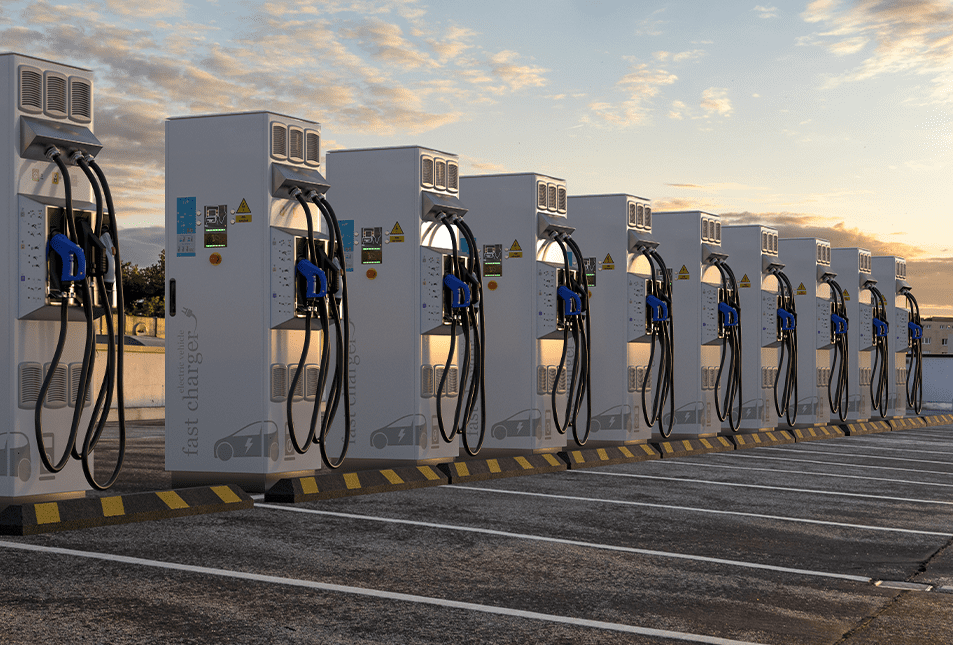

At the same time, BEVs continue to show continued market development. Public and private investments have accelerated the growth of dedicated shared fleet charging hubs. TRC expects the number of open and active medium-duty (MD) and HD charging ports within these hubs to nearly triple in the U.S. by 2025. Over the next five years, more than half of hubs will support high power charging as Megawatt Charging Standard (MCS) equipment becomes more widely available.

Utilities and technology developers are also innovating in advance of grid upgrades. Several utilities have introduced “flexible interconnect,” which allow fleets to access power earlier in a project lifecycle than may be possible otherwise, but they may not always have access to their maximum rated capacity. Linear generators, which can be powered by a wide range of gaseous fuels like propane or natural gas, can be installed in a matter of months – not years – for fleet operators that face long lead times for capacity upgrades.

BEV manufacturers faced significant challenges, with some scaling back production, delaying models, or declaring bankruptcy, but total MD and HD BEV registrations still reached a new high of 41,472 in 2024. Commercial cargo vans and pickup trucks accounted for 92% of new registrations, with 14,785 cargo vans, a 4% increase, and 23,188 trucks, up 95%. School bus registrations rose 47% to 1,436 units, while transit bus registrations fell 24% to 590 units. Tractor truck registrations increased 29% to 881 units.

Class 8 battery-electric trucks continue to gain traction, particularly in drayage and regional freight operations. In 2024, over one-fifth (22%) of regional logistics fleets in the annual survey reported operating at least one BEV. Urban delivery, maintenance, and municipal fleets also saw notable deployments, including electric shuttles for fixed-route operations at campuses, parks, and municipal facilities where noise and air quality are priorities.

Small fleets and independent operators face unique challenges in adopting BEVs, though signs of progress are emerging. This year’s fleet survey found that 18 fleets with five or fewer vehicles and 44 fleets with six to 50 vehicles integrated at least one BEV into their operations.

Despite substantial domestic investments in battery production and supply chains, vehicle cost savings for fleets have yet to materialize. As these supply chain investments take shape, industry stakeholders will closely watch whether they drive down costs and accelerate EV adoption.

Crucial federal hydrogen R&D support is in question while tractor and bus sales rise. New modular infrastructure emerges.

Crucial federal hydrogen R&D support is in question while tractor and bus sales rise. New modular infrastructure emerges.

The hydrogen industry is still in its early stages, and federal funding remains a critical factor in hydrogen’s long-term viability. The full impact of federal policy changes on the hydrogen sector remains uncertain, especially around hydrogen-specific federal initiatives like the Hydrogen Hubs investment program.

The adoption of hydrogen fuel cell electric buses (FCEBs) and Class 8 tractors (FCETs) is gaining traction. In 2024, 75 new fuel cell transit buses entered service, up from 29 in 2023, and recent funding awards suggest continued growth. Nikola led the charge in Class 8 tractor sales, reporting 200 in 2024 before declaring bankruptcy in early 2025, and Hyzon, debuted the nation’s first hydrogen fuel cell refuse truck before facing its own financial struggles. Despite such churn common to early-stage markets, leading OEMs such as Hyundai, a Kenworth and Toyota partnership, and a Daimler and Volvo partnership intend to bring hydrogen trucks to market over the next several years.

Fleets using FCETs have reported key benefits, with 56% citing excellent range and driver satisfaction compared to diesel trucks. With longer ranges, fast refueling, and a smaller fueling footprint, hydrogen fuel cells are also well-suited for transit and drayage operations, which have been early adopters.

As hydrogen fueling infrastructure develops, early adopters face supply limitations and market hurdles. Mobile fueling stations are emerging as a flexible, scalable solution to bridge infrastructure gaps and support initial deployments along key trucking corridors. However, after a year of ambitious announcements about the Department of Energy’s (DOE) regional clean hydrogen hubs (H2 Hubs), infrastructure expansion for fleets in the U.S. remains slow. Economic and policy challenges could hinder industry development in the coming years as cost parity is unlikely without incentives to support R&D for much of the next decade.

2025 Market Brief

Our yearly summary of major developments and fleet insights in sustainable commercial transportation and alternative fuels.

Download

Fleet Mini Guides

Short guides for fleets on starting out with electric, natural gas, hydrogen and propane vehicles and renewable fuels.

See More

Trend Briefs

Succinct updates on key trends influencing sustainable fleet adoption such as policy, funding, and autonomous vehicles.

See More

Webinars

Hear from fleet leaders and their partners on their outlook for and experience with sustainable technologies.

See More

Sign Up for Updates

Stay up to date with all State of Sustainable Fleets reports, briefs, and content by signing up below.

Webinars

Access all of the content from The State of Sustainable Fleets webinar series.

Developing a Fleet Electrification Program

Leading experts from NFI, First Student, Volvo, and Electrada shared their strategies and best practices for developing electric vehicle infrastructure projects.

View Recording

Building Utility and Other Charging Partnerships

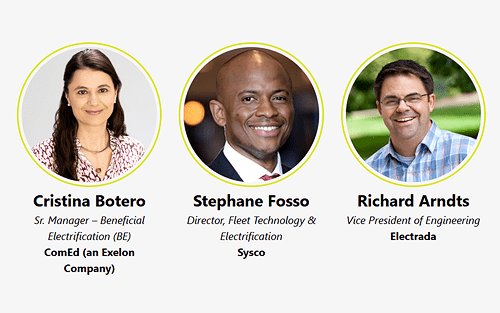

Leading experts from Sysco, Electrada, and Exelon described the essential partnerships, especially utilities, for successful fleet electrification projects.

View Recording

Integrating Charging Into Fleet Management

Leading experts from US Foods, First Student, Penske, and Geotab provided valuable case studies on designing a charging operation that maximizes uptime through effective planning and technology integration.

View Recording

Title Sponsors

Supporting Sponsors

Authored By

About

The State of Sustainable Fleets report gathers real-world data directly from early-adopter fleets across the U.S. to provide deep sector-specific insights into the adoption of natural gas, propane, battery electric, and hydrogen fuel cell electric vehicles, against a baseline of diesel and gasoline vehicles. The analysis includes public, private, and for-hire fleets, including school, municipal/shuttle, urban delivery, refuse, utility, transit, short-haul, and long-haul sectors. This first-of-its-kind report includes unique insights into vehicle sale trends, anticipated vehicle development timelines, real-world infrastructure and fuel costs, and the growing adoption of renewable fuels.

The on-road transportation industry is at a pivotal moment.

Key factors and major market forces are aligning to make this a critical time for the future of the industry.

Emissions on the Rise

With global greenhouse gas emissions and smog-forming pollutants continuing to rise, the industry is under growing pressure to rapidly adopt and deploy clean vehicle technologies.

Competing Technologies Emerging

Multiple promising vehicle technologies are emerging simultaneously, with more industry investment fueling innovation than ever before.

Mounting Sustainability Pressures

Globally, private companies and public regulators are stepping up to set ambitious sustainability goals and putting aggressive strategies in place to meet them.

Pace of Technology Quickening

After decades of research and development, the industry is moving from pilot projects to deployments of new technologies in real-world applications across sectors.

Determining a Path Forward

On-road fleets are weighing their options to determine which zero and near-zero emission vehicles can meet their operational needs—today and well into the future.